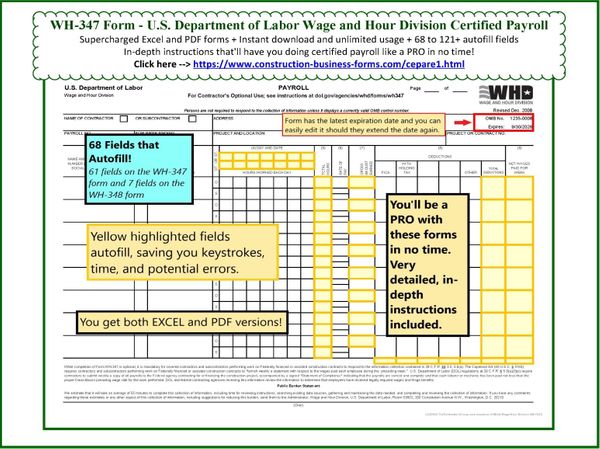

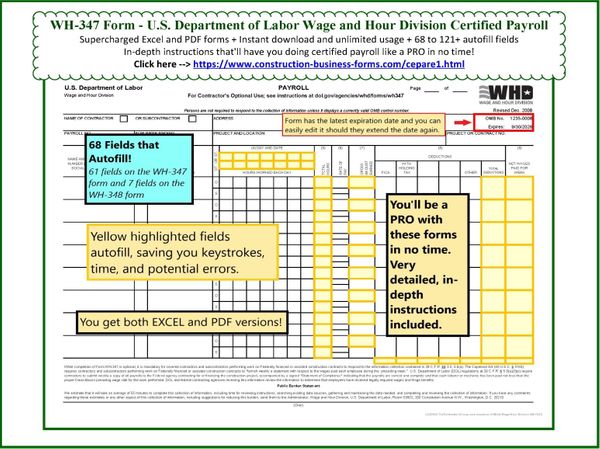

FEDERAL - WH-347/348 Certified Payroll Forms with 68 autofill fields - Excel and PDF included

NO monthly fees - each form is a one-time payment for unlimited, forever usage!

Who Uses The WH-347 Form & WH-348 Form (Statement of Compliance) and Why?

Free Bonuses! Double-Time and Bi-Weekly Forms Included!When contractors, subcontractors, sub-subs/etc., suppliers, etc., perform work on projects that involve federal funding, they're required to submit in-depth payroll information following Davis-Bacon and the USDOL Wage & Hour Division specific reporting requirements.

The WH-347 Payroll Report form and the WH-348 Statement of Compliance forms are designed for collecting and reporting that information.

These forms are also used by many states for when contractors need to report state-certified payroll.

USDOL Wage & Hour Changes WH-347 Form and Expiration Date!

The USDOL has extended the expiration date on the form, for the OMB number, from 07/31/2024 to 09/30/2026. It also changed the layout of the WH-347 form.

The WH-347 and WH-348 forms available on this webpage have all of the most recent updates (see the images and/or the PDF preview on this webpage).

In addition, it's now just a few simple keystrokes to edit the expiration date when and if the government extends the date again, which means you'll be able to continue using these forms without additional purchase! | |

What's included in this package of WH-347/348 forms

- WH-347 and 348 forms in Adobe PDF with 68 autofill fields that will save you an extraordinary amount of time!

This form, which works with Adobe Acrobat products including the free Adobe Acrobat Reader, has 8 employee rows. Because you get unlimited usage of our forms, no matter if you have to report for 50 or 100 or even 1000 or more employees you'll be able to do so using these forms. The included instructions explain how.

- WH-347 and 348 forms in EXCEL format with 68 autofill fields again saving you an extraordinary amount of time!

As mentioned above, the WH-347 form has 8 employee rows. Because you can easily add additional WH-347 forms (Excel worksheets) to the Excel workbook you'll always have enough no matter how many employees you have to report for. The included instructions explain how.

- Detailed and in-depth, yet easy to understand, instructions that teach you:

- How to fill in the forms with the exact required information

- How to report for employees that work under multiple classifications

- How to save even more time when reporting on multiple-week projects

- How to customize the forms to your company to save even more time

- How to keep track of multi-page forms when you have more employees than will fit on one page

- How to easily change the date when the OMB number expires in 2026 and continue using the form

- In addition, a copy of the instructional document posted at the USDOL is included in the instructions for your convenience.

- Free Bonus: Filled-in samples/examples of the forms.

- Free Bonus: A certified payroll form (PDF) laid out like the WH-347 but with extra rows to enter double-time - with auto-calculate and autofill fields.

- Free Bonus: A certified payroll form (EXCEL format) laid out like the WH-347 but with extra rows to enter double-time - with auto-calculate and autofill fields.

- Free Bonus: A bi-weekly certified payroll form (PDF) that's laid out like the WH-347/348 forms with 73 fields that auto-calculate and autofill (preview below).

- Free Bonus: A bi-weekly certified payroll form (EXCEL format) that's laid out like the WH-347/348 forms with 73 fields that auto-calculate and autofill (preview below)

… and everything works with Adobe Acrobat (including the free Reader) on Apple/Mac/Macintosh and Windows/PC computers!

PDF Previews

68 Autofill Fields - Eliminate Questions and Confusion *AND* Save a Substantial Amount of Time

Dealing with certified payroll requirements can be stressful. I was a nervous wreck with it myself when I first started so I understand. Please don't let it do that to you. I've made this form easy to fill in, I've added some cool little auto-fill features, I've included detailed instructions, and I'm here if you have any questions or worries.

These forms will have you doing certified payroll like a pro in no time!

Happy Customers

"I didn't know exactly what to expect when I placed my order. I was just trying to save time by not having to re-create a form from scratch. Diane FAR surpassed my expectations. I requested a change to a form, and she had it back to me THE SAME DAY! I will absolutely be a repeat customer! Diane's commitment to service goes far beyond what I could have imagined."

Jeremy Kilty - Paramount Installers LLC - Stratford, WI

"I appreciate your help sooooooooooooo much!!! Your Excel sheet is amazing - thank you for putting in all that work to share."

Leah D.

Arnold Electric Inc. – AEIOK.com

Tulsa OK

"I've been in business for 3 years. And I use the internet a lot for info. I spent 3 hours looking for a form and your site had it! THANKS!"

Shirley - Vacaville, CA

"Thank you, I LOVE this form. Your products are incredibly reasonable and I couldn't find a lower price........ I will always come to your website for all of my online form needs. I enjoy the ease of the Certified Payroll Form and it has saved me time and effort. Thanks Again!"

Janet Antonacci - United Fence Contractors, Inc. St. Louis, MO

"I love having this form electronically. It's made my world, working for the government, much easier!"

Best, Tom Newell - Newell Property Services, Inc.

Instant Download

Unlimited Usage

Unlimited Free Replacement

Unlimited Free Support

100% Satisfaction Guaranteed |

|

These supercharged WH-347 & WH-348 federal certified payroll forms have 68 fields that will autofill for you, based on entries in the other fields, saving you massive amounts of time and keystrokes!

This, in turn, reduces questions and confusion surrounding how to fill in the WH-347 form (and WH-348 form) because the fields autofill based on the USDOL rules.

Here's a list of the fields that'll autofill on the WH-347 form:

- "Day" fields in column 4 (7 fields - 14 on the bi-weekly form)

- "Date" fields in column 4 (7 fields - 14 on the bi-weekly form)

- "Total Straight-time Hours" field in column 5 (8 fields - 12 on the bi-weekly form)

- "Total Overtime Hours" field in column 5 (8 fields - 12 on the bi-weekly form)

- "Gross Amount Earned" field (top box) in column 7 (8 fields - 12 on the bi-weekly form)

- "Total Deductions" field in column 8 (8 fields - 12 on the bi-weekly form)

- "Net Wages Paid For Week" field in column 9 (8 fields - 12 on the bi-weekly form)

- Column totals at the bottom (7 fields)

For even more autofill fields on the WH-347 form, check out our WH-347 form premium, turbocharged Excel workbook that'll autocalculate and autofill over 130 fields!

And here's a list of the fields that'll autofill on the WH-348 form:

- "Contractor or Subcontractor" field (1 field)

- "Building or Work" field (1 field)

- "... payroll commencing date" field (1 field)

- "... payroll ending date" field (1 field)

- "... of said employer" field (1 field)

- "Name" field (1 field)

- "Title" field (1 field)

The time saved when using these forms is substantial!

OMB Number and Expiration Date

The current OMB Number on the WH-347 form was extended by the government in late 2023 from July 31, 2024, to September 30, 2026. When it expires, the USDOL Wage & Hour Division may leave the current reporting requirements in place and do nothing more than extend the expiration date or they may change the OMB Number and reporting requirements and assign a new expiration date.

If the reporting requirements don't change you'll be able to easily edit the OMB number expiration date on this Excel form and continue using it through at least the next expiration date.

If the reporting requirements do change, we will strive to offer a new package that meets the new requirements before the current expiration date. Please contact us to purchase an updated package.

Tips and Tricks

I've included within the downloadable package some tips and tricks to make certified payroll even easier for you. The easy-to-understand instructions explain:

- How to customize the forms to your company to even further reduce, by more than half, the amount of time you spend filling in payroll reports (and reduce the change for typos).

- How to report payroll for employees who work under multiple classifications on a project.

- How to even further reduce time spent when reporting your certified payroll on multi-week jobs.

After You've Completed Your Purchase

Your receipt page, and the instant receipt/confirmation email that you'll receive, each have download buttons.

When you click either of those download buttons the zipped form package will download to your computer and automatically unzip itself, presenting you with the forms and instructions that you'll be able to use immediately.

Federal Certified Payrolls Must Be Paid and Reported Weekly!

Please use the weekly version included in this package when doing Davis-Bacon federal certified payroll.

The Copeland Act (40 U.S. Code § 3142(c)(1)) states that “the contractor or subcontractor shall pay all mechanics and laborers employed directly on the site of the work, unconditionally and at least once a week, and without subsequent deduction or rebate on any account, the full amounts accrued at time of payment, computed at wage rates not less than those stated in the advertised specifications".

The regulations at 29 CFR 5.5(a)(1), which provide the language for the contract clauses that are incorporated into the Davis-Bacon contracts and that the contractor agrees to by signing, similarly state that laborers and mechanics “will be paid unconditionally and not less often than once a week, and without subsequent deduction or rebate on any account (except such payroll deductions as are permitted by regulations issued by the Secretary of Labor under the Copeland Act (29 CFR part 3)), the full amount of wages and bona fide fringe benefits (or cash equivalents thereof) due.

The Copeland Act (40 U.S.C. § 3145) requires contractors and subcontractors performing work on Federally financed or assisted construction contracts to "furnish weekly a statement with respect to the wages paid each employee during the preceding week."

U.S. Department of Labor (DOL) Regulations at 29 C.F.R. § 5.5(a)(3)(ii) require contractors to submit submit weekly a copy of all payrolls to the Federal agency contracting for or financing the construction project, accompanied by a signed "Statement of Compliance" indicating that the payrolls are correct and complete and that each laborer or mechanic has been paid not less than the proper Davis-Bacon prevailing wage rate for the work performed.

The U.S. Department of Labor (DOL) Wage & Hour Division has stated that because federal certified payroll MUST be paid no less than once per week, and MUST be reported weekly per Davis-Bacon, a biweekly version is not valid and must not be used.

Always pay your federal payroll weekly and always submit your federal payroll reports in single-week format. [Back]

USDOL Wage & Hour Division (aka Department) Clarifies Rules for Employees with Multiple Classifications

The Department clarified reporting requirements that have to do with employees who work under more than one classification on a project.

Contractors and subcontractors are required to include on their certified payroll submissions (and keep records of) hours worked by an employee broken down by each separate classification of work performed by that employee. If the employee works under two or more classifications on a project, there must be a separate entry for each classification that shows the hours worked and monies earned under each classification.

If a contractor or subcontractor fails to report the breakdown accurately and/or maintain such records of actual daily and weekly hours worked and the correct classifications for those hours worked, then it must pay workers the rates of the classification of work performed with the highest prevailing wage and fringe benefits due.

This Excel form and the in-depth instructions make entering, tracking, and reporting multiple-classification employees very easy and simple!

The instructions walk through step-by-step how to enter multiple-classification employees on the WH-347 form to meet the Department’s requirements. And anytime you might have questions, I'm here to help. :o)

USDOL Wage & Hour Division (aka Department) Institutes New Recordkeeping Requirements

The Department recently added two new recordkeeping requirements for contractors to the collection under 1235–0008 (telephone # and email address; social security number and mailing address were already required). However, like the social security # and mailing address, they don’t want this information added to the “certified payrolls” submission (such as the WH–347 instrument); rather, this information must be maintained in-house and then provided to DOL and other agencies on request. Be sure to immediately start keeping this information on hand. If you use Excel, our enhanced Premium Excel workbook makes it easy to keep all the info in one place!

Submission of Federal Certified Payroll

While completion of Form WH-347 is optional, it is mandatory for covered contractors and subcontractors performing work on Federally financed or assisted construction contracts to respond to the information collection contained in 29 C.F.R. §§ 3.3, 5.5(a). The Copeland Act (40 U.S.C. § 3145) requires contractors and subcontractors performing work on Federally financed or assisted construction contracts to "furnish weekly a statement with respect to the wages paid each employee during the preceding week." U.S. Department of Labor (DOL) Regulations at 29 C.F.R. § 5.5(a)(3)(ii) require contractors to submit weekly a copy of all payrolls to the Federal agency contracting for or financing the construction project, accompanied by a signed "Statement of Compliance" indicating that the payrolls are correct and complete and that each laborer or mechanic has been paid not less than the proper Davis-Bacon prevailing wage rate for the work performed. DOL and federal contracting agencies receiving this information review the information to determine that employees have received legally required wages and fringe benefits.

There is a simple PDF form available through the federal government website that you can download and use for free. The USDOL estimates it’ll take you 55 minutes to fill out their version but in talking with contractors about their experiences it's clear that it can easily take double or triple that time, and even more if you have a large field crew. In addition, there's the anxiety-factor involved when trying to understand how to fill in the forms correctly. Our supercharged Excel and PDF forms available here at our website, with multiple auto-calculating and autofill fields and in-depth instructions, will not only save you so much time over that simpler PDF document, they'll also eliminate the anxiety tied to certified payroll forms!

|

- Federal Certified Payrolls Must Be Paid and Reported Weekly -

The USDOL Wage & Hour Division has stated that federal certified payroll MUST be paid no less than once per week, and MUST be reported weekly per Davis-Bacon.

Do not pay your federal payroll less often than once per week and do not submit your federal payroll on a biweekly form. |

|

|

WH-347 Certified Payroll Form, Double-Time Certified Payroll Form, Bi-Weekly Certified Payroll Form, and WH-348 Certification Form

Other Options

We have a premium, turbocharged Excel workbook that'll autocalculate and autofill over 130 fields in the WH-347/348 forms, allowing you to have completed forms in your hands in mere minutes. Check it out here!

Back to top of this page: WH-347 Form and WH-348 Form USDOL WH-347 Form & WH-348 Form - Federal Certified Payroll Form and Statement of Compliance

Back to the home page: Download Construction Forms

Accessories