NEW JERSEY - MW-562 Payroll Certification for Public Works Projects - Excel and PDF included

NO monthly fees - each form is a one-time payment for unlimited, forever usage!

Back to the top of this page: MW-562 NJ Certified Payroll Forms for Public Works Projects

Back to main certified payroll page: Certified Payroll Forms

Back to home page: Construction Business Forms

*MW-562 replaces NJPCFPWP

What's included in your purchase of the MW-562 New Jersey Payroll Certification For Public Works Projects form:

|

New June 2023 design

The forms that download to your computer after your purchase are in Excel and PDF.

The Excel version works on all Windows and Macintosh computers that have Excel installed. The PDF works on all computers that have the free Adobe Acrobat Reader installed (usually pre-installed on most computers).

This form will do several of your calculations for you. You can save it after you fill it in (I usually suggest including the job name and/or number in the file name) and if you need to change some-thing you filled in you can go in and change it and re-save it.

You'll be able to use the form as often as you need it, kind of like a never-ending pad of forms but cooler because they can be filled in with your computer. :)

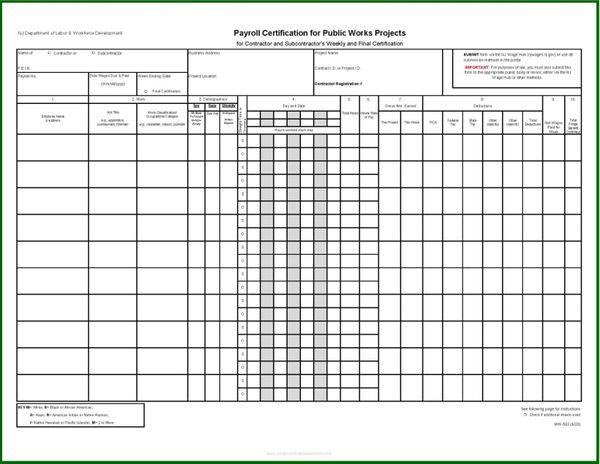

Here's a preview of the MW-562 New Jersey Payroll Certification for Public Works Projects Form. Please note that this preview is out of date, it's the 9/19 version. The downloaded package contains the new 06/23 version.

Who Uses The MW-562 NJ Certified Payroll Form And Why

So who needs this payroll form? Any contractor (Generals and Subs) performing work on an NJ public works project must fill out and submit the New Jersey certified payroll form to the public body/entity.

This is the case whether the worker is an employee or owner of the company. The information is required for everyone who does any work on the project.

A "certified payroll record" or form is a record of what each employee/worker was paid, when they were paid, and what the deductions were. It also shows hours worked and days worked along with additional information.

A principal or authorized agent of the general contracting or subcontracting company working on the public works project signs the payroll form certifying that it's accurate and true.

How To Tell If The Project You're Working On Is A Public Works Project

In New Jersey, per the current NJ State Prevailing Wage Act and Regulations (34:11-56.26.(5))

[scroll down to (5) when you get there], a public works project is construction, reconstruction,

demolition, alteration, custom fabrication, or repair work, or maintenance work, including painting

and decorating, done under contract and paid for in whole or in part out of the funds of a public

body, except work performed under a rehabilitation program.

It also means construction, reconstruction, demolition, alteration, custom fabrication, or repair

work, done on any property or premises, whether or not the work is paid for from public

funds, if, at the time of the entering into of the contract the property or premises is owned

by the public body or:

(a) Not less than 55% of the property or premises is leased by a public body, or is subject to an

agreement to be subsequently leased by the public body; and

(b) The portion of the property or premises that is leased or subject to an agreement to be subs-

equently leased by the public body measures more than 20,000 square feet.

If the project you're working on, or will be working on, falls into the above description then you're

on a public works project and you have to do the NJ certified payroll form.

MW-562 NJ Certified Payroll Form Instructions

After you add the form to your cart and complete your purchase you'll have a download button

to download the form.

Once it downloads to your computer (I usually suggest downloading it to your desktop and then

moving it from there to wherever you'd like it to be) then you can click on it to open it in Excel,

fill it in and let it do its calculations, save it under a different file name, print it, and you're ready

to go.

With unlimited usage you'll be able to use it as often as you need on as many projects as you

need. Plus with unlimited free support you can ask me for help any time you might need.

Filling in certified payroll forms can be a pain at times. When you use this form you'll just tab

from field to field to fill it in. It's as simple as that.

Who Does Work On A New Jersey Public Works Project

In order to do work on public works projects in New Jersey a contractor/subcontractor must be

registered with the Department of Labor and Workforce Development following the requirements

of the Public Works Contractor Registration Act 34:11-56.48. Short title.

You'll be required to pay prevailing wage rates for the various classifications of work in your portion

of the project. These rates have to be paid throughout the project for all hours each employee

works on the project.

If you're here to purchase the MW-562 NJ Certified Payroll Form then chances are you already know your

wage rates (but don't forget to check again before you accept the contract if you're awarded the

job to make sure the rates you bid your project are still those rates and not higher). For those

contractors who don't know this, unlike some states, New Jersey makes you apply for your

prevailing wage rates for every project. You'll have to do that in order to get the rates you need

in order to bid your public works project.

You'll have to post a notice in an obvious area where your employees will be able to see and

read it. This notice has to have the wage determination rates for each classification. This gives

employees an opportunity to find out if they're being paid the proper wages or not.

You have to pay your employees no less than twice per month and you're required to submit

certified payroll records to the public body/entity within 10 days of each pay day.

You'll be required to permit on-site inspection and employee interviews by authorized

representatives of the Commissioner of Labor and Workforce Development.

Should they be requested you'll be required to produce payroll-related records to authorized

representatives of the Commissioner within 10 days of that request.

Penalties for not paying correct prevailing wage rates

The NJ State Prevailing Wage Act and Regulations 34:11-56.35. Violations; penalties outlines the

penalties for violating the prevailing wage law. Those penalties can be pretty steep including being

punished under criminal law. There can be several offenses incurred by one contractor on one

project because each week is counted as a additional or separate offense.

- No less than $100 in fines and no more than $1000

- Jail/Prison no less than 10 days and no more than 90 days

- Other fines up to $5,000

- Additional jail/prison time should the offense(s) be determined as criminal

How To Get Your Own Copy Of The NJ Certified Payroll Form

Getting to your new form(s) is really quick and easy.

If your downloaded package won't unzip, don't purchase an unzip program - email me instead and I'll email the already-unzipped forms to you. :)

- Click the Add to Cart button (then click the Add to Cart button for any other forms you might need)

- Complete your checkout on your cart page

- Download your form(s)

Please click here to get back to the Add To Cart button and you'll be on your way.

Back to the top of this page: MW-562 NJ Certified Payroll Forms for Public Works Projects

Back to main certified payroll page: Certified Payroll Forms

Back to home page: Construction Business Forms

*MW-562 replaces NJPCFPWP